Understanding CPI: What is it?

The CPI, or Consumer Price Index, is a measure of how the prices of goods and services change over time and is most commonly used as a yardstick for inflation and how it affects the average consumer.

Typically released by the US Bureau of Labour Statistics (BLS) on the second Wednesday of the month, the CPI report remains one of the most important data releases, proving a key measure of performance for the US economy, similarly to events like non-farm payrolls, interest rate decisions, and gross domestic product (GDP).

How is the CPI calculated?

In a nutshell, the value of the CPI is determined by a series of calculations made by the US Bureau of Labour Statistics (BLS), in which ~80,000 individual prices are collected from thousands of businesses across the United States of America.

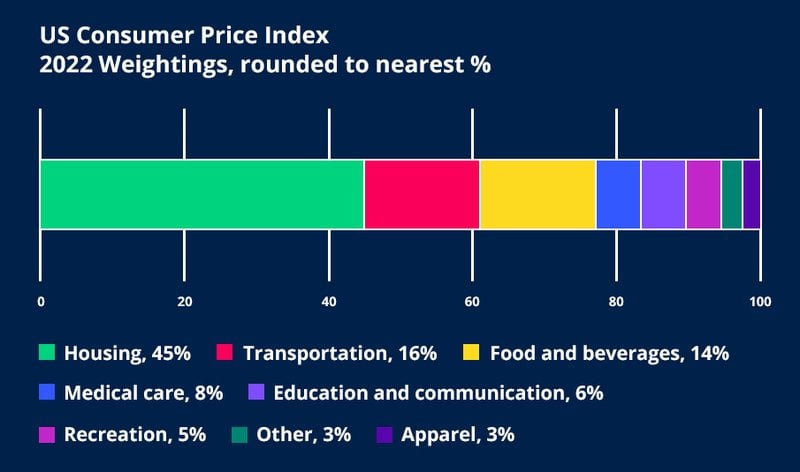

By design, the CPI is intended to reflect changes in price for the average consumer, and therefore its value is determined by fluctuations in the prices of these major categories, sometimes referred to as ‘the basket’:

- Apparel - the cost of clothing and footwear.

- Education and communication - the cost of educational services, like university tuition, and communication tools, such as a phone plan or internet access.

- Food and beverages - the cost of groceries and restaurant meals.

- Housing - the cost of shelter, either traditional rent payments or owners’ equivalent (OER).

- Medical care - the cost of medical services, including prescription drugs and doctor appointments.

- Recreation - the cost of leisure activities, including concerts and cinema tickets.

- Transportation - the cost of getting around, for example, maintaining a vehicle and the associated fuel cost, or public transport.

- Other - a ‘catch-all’ category covering a wide range of goods and services otherwise not covered in other groups.

It should be noted, however, that each category is not weighted equally as part of the calculation and is instead aimed at being representative of how each dollar in the U.S. is spent.

For example, if the average consumer budgets 50% of their income on housing, half the CPI’s value will be determined by fluctuations in housing prices, with the other seven categories making up the remaining 50%.

Why does CPI matter to forex traders?

Volatility

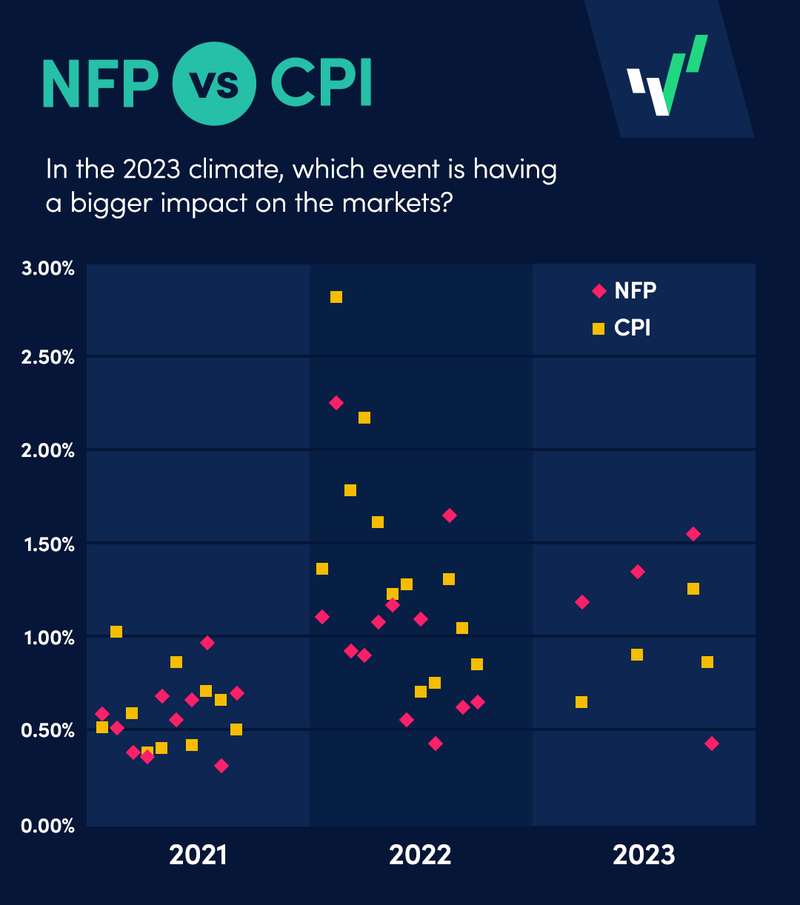

Undeniably one of the headline fundamental events of any calendar month, the US Consumer Price Index is followed globally by traders alike and promotes a higher-than-average level of volatility in the currency markets, often matching a similar level to non-farm payrolls (NFP).

Large swings in price, such as those offered by CPI events historically, can offer trading opportunities along with the potential for higher returns, but not without the associated high level of risk.

Inflation

Put simply, understanding the mechanism of inflation and how purchasing power changes over time, especially in relation to other fiat currencies, is key to many aspects of fundamental analysis.

With the CPI synonymous with measuring inflation, traders with a better grasp on how inflation affects the forex market may be better able to identify longer-term trends in price, helping narrow down potential trading opportunities.

Monetary policy

As a phenomenon all too familiar in recent years, central banks raise interest rates to combat rising inflation as part of monetary policy.

When compared to the rates of other currencies, higher interest rates tend to make a currency more attractive for investment, potentially causing its value to increase.

By virtue, a series of higher-than-expected CPI reports could lead to interest rate hikes by a central bank, likely affecting currency value.

Understanding such connections can help traders make more informed decisions when seeking opportunities to trade.

Trading the CPI Report

Typically released at 08:30 EST on the second Wednesday of each month, the hours leading up to the CPI report can prove eventful as traders anticipate what each potential outcome would mean for the financial markets.

As the event draws nearer, trading volume usually increases, with traders either closing or placing positions in line with their own trading strategies.

Once the data has been fully released, a major market reaction can be expected.

The scope of this reaction entirely depends on the outcome of the report; if the CPI is either much higher or much lower than consensus expectations, currency prices can change rapidly, with volatility continuing some time after the initial release.

It’s worth noting, however, that in moments of extreme market volatility, price movements can appear nonsensical, with this phenomenon sometimes coined ‘whipsaw’ trading conditions. This level of total unpredictability poses a risk to traders and their accounts, with some choosing to avoid trading fundamental news events such as CPI releases altogether.

To conclude

Among the ranks of high-impact US fundamental events, the CPI remains steadfast as one of the most significant.

Whether looking to trade each release or simply factoring it into your broader trading strategy, the importance of the Consumer Price Index to the financial markets cannot be denied.

Trade fundamental news events with OANDA

Whether you’re looking to trade a Consumer Price Index release or an entirely different market-moving event, open an account with OANDA today to take advantage of powerful analysis tools and tight spreads on your favorite forex pairs.

Frequently Asked Questions (FAQ)

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) is a measure of how the prices of goods and services change over time. The CPI is also one of the most commonly used measures of currency inflation.

Why does the Consumer Price Index (CPI) matter to forex traders?

The release of CPI data can help boost market volatility, which may help traders find a trading opportunity. Otherwise, traders can also build a better understanding of how inflation affects the forex market by studying the Consumer Price Index, both in terms of currency purchasing power and monetary policy decisions intended to keep inflation under control.

When is the Consumer Price Index (CPI) due to be released next?

The next three CPI events are expected on July 11th 2024, August 14th 2024 and September 11th 2024 respectively.

Disclaimer

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results.

It is not investment advice or a solution to buy or sell instruments. Opinions are the authors; not necessarily those of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and is not suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Losses can exceed deposits.