Choosing the right currency pair for your trading

With the seven major currencies forming over twenty-five unique forex pairs alone, making a choice on which to trade can feel overwhelming, especially when many different variables contribute to the probability of a successful trade.

For most traders, however, monitoring the price action of multiple currency pairs simultaneously is unfeasible, and can often prove counterproductive in finding a trading opportunity.

With the focus being limited, using techniques to better determine where your attention is best spent can be key to success as a trader, and in this article, we discuss some of these.

Top 5 Factors for Choosing Which Forex Pair to Trade

1. How volatility affects the forex market

Sometimes referred to as the ‘heartbeat’ of the market, knowing which currency is not only currently moving the most, but also has the highest propensity for moving in the future, can make the difference in finding a successful trade.

Measuring the level of current volatility is possible by a range of technical indicators such as Average True Range (ATR), Standard Deviation, and Bollinger Bands, and such information can be factored into your broader trading decision-making.

2. Forex backtesting and historical performance

Although sharing common ground, movement in the prices of any individual currency pair can be caused by a number of unique factors. For example, USD/CAD is unique in its connection to world oil prices and is typically said to be positively correlated.

By virtue, it's likely that trading performance will vary across different currency pairs depending on your chosen strategy, so it’s important to first understand under what conditions your strategy works most optimally, especially in terms of which currency pairs to trade.

Enter backtesting, a risk-free means of testing any trading system.

For example, imagine a trading system that has one rule: to place a long position on EUR/USD when declared as ‘oversold’ by the Relative Strength Index (RSI), with parameters set to either a 20-pip take-profit or stop-loss. To backtest this system, you would first need to go back to a predetermined time in history, then test each occasion on which this exact scenario happened, making a record of performance.

Once completed over a considerable amount of trades, a reliable impression of overall strategy effectiveness can be ascertained, especially in regards to which pairs your trading system is best suited towards, and can therefore help direct your focus on which currency pairs to trade.

3. Understanding different trading sessions

With the forex market open twenty-four hours a day, five days a week, activity in certain currency pairs can be reliably predicted in line with the working days of major world economies, like the United States, London, and Japan.

Traditionally speaking, there are four major trading sessions in the forex market:

- The Sydney session, roughly 15:00 - 00:00 EST

- The Tokyo session, roughly 23:30 - 08:00 EST

- The London session, roughly 03:00 - 12:00 EST

- The New York session, roughly 12:00 EST - 17:00 EST

Owing to how the time zone of each respective country varies, there can be some overlap between each session, with the New York, London and Tokyo sessions typically seen as the most volatile.

Knowing how every twenty-four hours in the forex market is structured can help guide trading decisions, including which currency pair to trade. For example, we can expect USD/JPY to experience higher levels of volatility in both the New York and Tokyo sessions.

4. Fundamental events and news releases

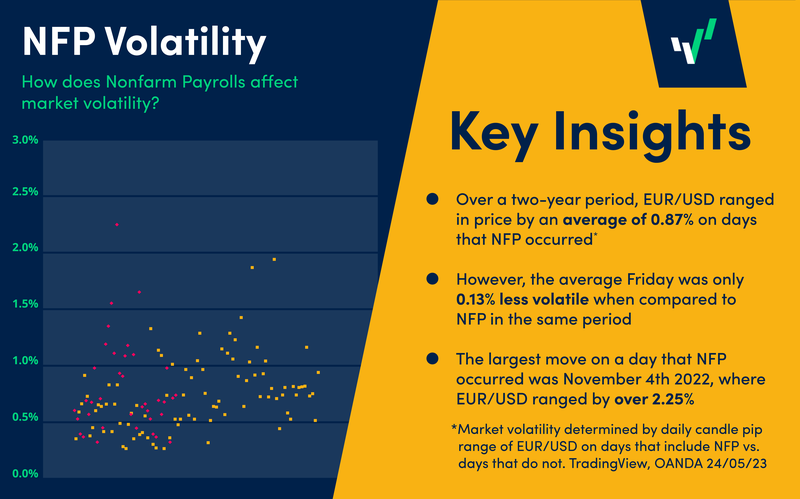

Viewed by some as synonymous with trading opportunities, the market impact of fundamental news events such as Non-Farm Payrolls (NFP), CPI releases, and interest rate decisions is undeniable.

Whether you choose to trade news releases or otherwise, the often increased levels of volatility cannot be ignored when deciding which currency pair to trade; for example, if NFP is expected later today, you might be more inclined to trade pairs like EUR/USD, GBP/USD, and USD/JPY.

5. Spread and transaction costs

The costs associated with trading not only change from broker-to-broker, but will also vary on the basis of what you’re trading and when.

Typically, when a higher number of trades are being placed on any one instrument at a given time, the market is more liquid, which can result in lower associated trading costs, especially in terms of spread.

When selecting a currency pair to trade, traders would be well advised to consider how the potential for swap fees could affect their trade, especially on Wednesdays when swap is usually either paid or deducted at triple the usual value.

Enjoy competitive spreads with OANDA

Whichever currency pair you choose to trade, take advantage of tight spreads with OANDA.

Over past 25 years, OANDA has built a stellar reputation for not only award-winning trading platforms* and innovative trading education but also transparent pricing, helping you understand how costs affect your trading.

Open an account with OANDA today.

Frequently Asked Questions (FAQ)

How do I choose which currency pair to trade?

In any situation, knowing which currency pair would be best to trade relies on many different factors, including market volatility, the current trading session, and your own personal trading strategy.

What is the best time to trade EUR/USD?

There is no one time that is consistently the best to trade EUR/USD, as this will vary depending on several different factors. With that said, EUR/USD typically sees its highest levels of volatility in both the London and New York trading sessions, which may be more conducive to finding a trading opportunity.

Disclaimer

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results.

Opinions are the author's; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and is not suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading.

Footnotes

*Awarded highest client satisfaction for mobile platform/app (Investment Trends 2021 US Leverage Trading Report, Margin Forex)