How were the BRICS started?

Within the moniker of ‘emerging markets’, the BRICS make up a set of countries that have experienced above-average economic growth over the past decade, especially when compared to major world economies.

In FX, the majority of attention goes to the G7 currencies, as they have historically provided the most liquidity, and some traders feel they have a better grasp of the overall trends in the advanced economies. Brazil, Russia, India, and China made up the original BRIC group, holding high-level talks in the summer of 2006 to boost economic links, encourage international dispute resolution, and reform international finance. In June 2019, the first BRIC summit was held in Yekaterinburg, Russia, where South Africa was admitted as a full member the following year, and the BRIC organization was renamed BRICS.

The BRICS are more than just an emerging market trade

The BRICS are an important grouping of major emerging market economies that can provide several insights into global economic growth trends. China and India alone make up over one-third of the world’s population, so it should not come as a surprise that significant worldwide investment is being made in these economies.

The BRICS three pillars of cooperation include the principles of mutual respect, sovereign equality, inclusiveness, consensus, and strengthened collaboration. BRICS aims to be a partnership of influential countries that champion inclusive multilateralism.

Varied central bank themes

Given all the stimulus that has flooded financial markets during the global financial crisis and COVID-19, the emerging market trade has blossomed, seeing a tremendous amount of investment in their respective economies.

Otherwise, in current times, low interest rates in most of the advanced economies have also caused the interest rate differential to widely swing in favor of most emerging market currencies.

Over the past couple of economic cycles, emerging markets have typically faced inflationary pressures before those of the advanced economies, which pressured their respective central banks to be the first ones to tighten monetary policy aggressively.

The De-dollarization movement

There are many factors that have led to a growing de-dollarization movement.

For some countries, geopolitical conflicts on trade, growth, and innovation have motivated some to move away from the dollar. Given the US federal deficit and debt, higher borrowing costs will be a major strain on the US to meet all its obligations. If US debt holders decide to abandon their holdings, bond market chaos could lead to excessive FX moves.

Ultimately, some countries are becoming more skeptical of the dollar as the world's reserve currency, and that is leading some countries to seek diversification away from the greenback.

What are the BRIC countries?

Brazil

When traders think of Brazil, some think of a commodity-rich country that is a key part of the emerging market trade.

Brazil's top exports include iron ore, soybeans, crude oil, raw sugar, and poultry meat, with almost half of Brazil’s exports coming from just five trading partners: China, the US, Argentina, the Netherlands, and Spain. Given the diverse subset of partners, if Brazilian exports are thriving, that could indicate the global growth outlook is strong.

What makes Brazil a key economy to follow is that they are extremely sensitive to global trends and oftentimes have a proactive central bank, as their economies often feel the impact first of major swings in sentiment.

Russia

Prior to the war in Ukraine, Russia had a very diverse group of trading partners. With economic sanctions from the West sending the ruble to record low levels, the risks of destabilizing Russia grow.

In recent years, Russia has increased its dependence on China, which has been their most important trading partner over the past two decades.

Russia has been a major exporter of both crude and natural gas. With sanctions forcing Europe to find alternatives to Russian energy, the oil market has been very tight, which has kept energy prices volatile while also having a major impact on global inflation trends.

India

With India becoming the world’s most populous nation, it is starting to get noticed as a pivotal contributor to the global economy.

Assuming a ‘Goldilocks’ outlook (not too good but not bad at all), India could enjoy mid-single-digit growth for the rest of the decade. Recent economic growth was driven by outperformance in both construction and agriculture, while manufacturing growth remains healthy.

Meanwhile, India’s history with foreign trade has remained volatile, with the country becoming less import-dependent for critical goods such as food grains.

India accounts for around 7.2% of the global economy, and that could grow as long as global drivers remain upbeat and if we do not see global energy crisis concerns return.

China

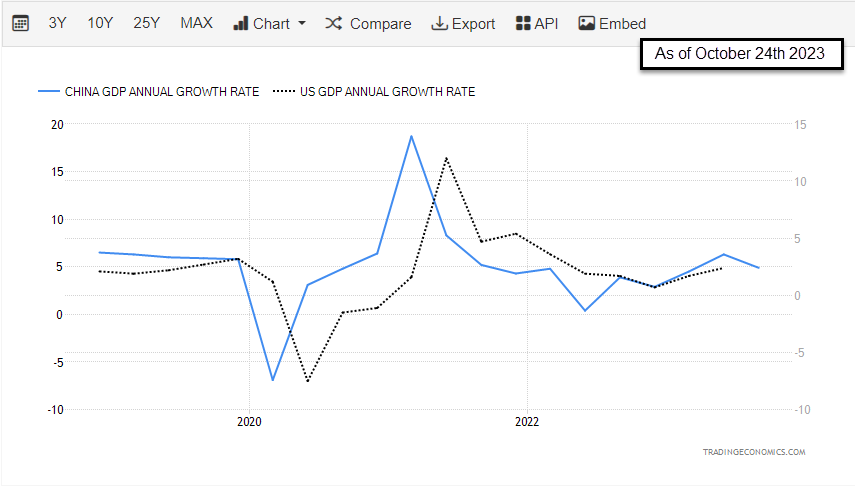

China’s economy has an overwhelming influence that is felt all around the world. It is the second-largest economy in the world, and before 2023, it was widely expected to surpass the US economy.

A strong USD compared to a weaker Yuan and the continuously rising debt to GDP ratio in China may represent some of the factors that led to change this perspective.

China is prioritizing economic growth and industrial upgrading while still keeping manufacturing jobs for Chinese workers. China is both a key buyer and seller of goods, and when the economy is thriving, this is often perceived as a good sign for global growth.

On the contrary, when China is struggling, this can be bad news for the eurozone as the Chinese won’t be buying as many goods. China is also a large holder of US Treasury bonds, and if they need to free up cash to defend the Chinese yuan, that could cause chaos in fixed-income markets.

If global growth prospects are upbeat, chances are that China is likely responsible for some of that optimism.

South Africa

South Africa is one of the emerging markets that has significant structural problems with both employment and an energy crisis. South Africa has also been seeking investment from other countries, as, fundamentally, they are a very resource-rich country, with their key exports including corn, diamonds, precious metals and minerals, sugar, and wool.

The African country has also had to deal with age-old problems of political uncertainty.

It can be said that South Africa isn’t one of the strongest emerging market economies, but that could change if they continue to build upon their partnerships with some of the largest economies.

The South African Rand has been on a steady path of underperformance against the US Dollar (USD/ZAR), the South African Rand (ZAR) exchange rate improved in March 2020, however by June 2021, all gains were erased and the Rand continued to underperform against the USD, taking the exchange rate for USD/ZAR back up to an all-time high of 19.90, above the pre-pandemic high of 19.22.

The South African Rand is tradeable against multiple currencies and most commonly traded against USD, The volatile nature of USD/ZAR is heavily influenced by its economic and political status.

Analyze emerging markets with OANDA

Interested in trading the Dollar and other emerging market currency pairs? Learn how to trade as a forex trader.

To try your hand at forex trading and experiment with the volatility that comes with emerging market currencies, apply for a demo forex account at oanda.com.

Disclaimer

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results.

It is not investment advice or a solution to buy or sell instruments. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks. Losses can exceed deposits.